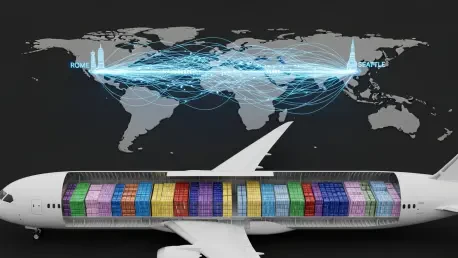

With decades of experience navigating the complexities of global supply chains, Rohit Laila offers a unique perspective on the forces shaping the logistics industry. His passion for technology and innovation provides a lens through which we can understand the strategic moves of major players. Today, we delve into a significant new partnership between Global GSA Group and Alaska Airlines, exploring how a new direct route from Rome to Seattle is set to reshape transatlantic cargo flows. The conversation will touch upon the operational rollout of this service, the intricate logistics of handling high-value Italian goods, its strategic importance for Alaska Airlines’ expansion, the journey of a typical shipment through this new gateway, and how the airline’s recent acquisition of Hawaiian Airlines creates a formidable new entity in the cargo market.

This new GSSA partnership is set to launch daily flights from Rome in late April. Could you walk us through the initial steps Global GSA will take to market this new cargo capacity and what specific benefits this direct connection offers to Italian forwarders?

Our first move is always to connect directly with our partners on the ground. We have a very close, long-standing cooperation with the Italian forwarding community, so our initial outreach will be a focused effort to demonstrate the immense value this new route provides. We’re not just selling space on a plane; we’re offering a direct artery into the U.S. Pacific Northwest. For a country that exports such a variety of high-value, time-sensitive goods, eliminating a layover in a crowded European or East Coast hub is a game-changer. This means faster transit times, less handling, and greater security for their shipments, which is a powerful message we’ll be carrying to them.

The daily Boeing 787-9 flights will carry diverse cargo, from high fashion to pharmaceuticals and machine parts. What are the unique logistical challenges for these high-value commodities, and how does your expertise ensure their efficient transport into the Pacific Northwest and beyond?

Handling such a diverse and valuable manifest requires precision at every step. High fashion isn’t just clothing; it’s a high-stakes, season-driven product that demands pristine condition upon arrival. Pharmaceuticals often require unbroken cold chains and meticulous documentation. Machine parts can be heavy, oddly shaped, and critical for a production line waiting across the ocean. Our expertise lies in understanding these nuances. We don’t see a mixed pallet; we see individual supply chains. We ensure the correct handling protocols are in place from the moment we accept the cargo in Rome, through the flight, and into the seamless transfer at the Seattle hub. It’s this specialized care that builds trust and makes a route like this successful.

Cargo is a key revenue diversifier for Alaska Airlines as it expands its global footprint. How does this Rome-Seattle route specifically strengthen the airline’s transatlantic business, and what metrics will you use to measure success in positioning Seattle as a primary gateway to North America?

This Rome-Seattle route is a cornerstone of Alaska’s strategy. It’s not just about adding another pin on the map; it’s about creating a robust, two-way commercial bridge. For Alaska, this service solidifies their transatlantic presence and leverages their West Coast dominance. Success won’t just be measured by load factors, though those are crucial. We’ll be looking at the diversity of cargo, the volume of freight that connects through Seattle to the over 100 other destinations, and the growth in new forwarding partnerships. The ultimate goal is to see Seattle become synonymous with efficient, reliable access to all of North America for European exporters. When Italian forwarders think “Pacific Northwest and beyond,” we want them to instinctively think of this flight.

From Seattle, freight can connect to over 100 destinations. Could you share an example of a typical journey for a shipment originating in Rome, detailing the process and timeline for it to reach a final destination in Latin America or the Asia Pacific region?

Imagine a shipment of luxury Italian leather goods destined for a high-end retailer in Lima. That journey begins at our facility in Rome, where it’s carefully loaded onto the daily Boeing 787-9. After the direct flight, it arrives in Seattle, our key gateway. There, it’s efficiently transferred within Alaska’s network. The real power here is the connectivity. The shipment is then booked on a connecting flight, perhaps to Los Angeles, and then onward to Latin America. Thanks to the direct transatlantic leg, we can cut significant time and handling out of the process, turning a complex multi-leg journey into a streamlined, reliable service that gets that high-value product to its final market faster and more securely.

With Alaska Air Group’s acquisition of Hawaiian Airlines, the combined carrier has a long legacy. How does this expanded network influence your strategy for attracting new forwarding partners, and what new opportunities does the merger create for the transatlantic cargo business?

The acquisition is transformative. We are now representing a brand-new carrier built on the foundation of almost 200 years of combined history. This isn’t just about adding more destinations; it’s about creating an unparalleled network. For our European partners, we can now offer a single-carrier solution not just to the U.S. West Coast, but deep into the Pacific, including Hawaii and key hubs for Asia-Pacific connections. This makes our proposition incredibly compelling. We can go to a forwarder in Italy and offer a seamless connection for their goods all the way to Honolulu or beyond, backed by the history and reliability of these two storied airlines. It opens up entirely new trade lanes and market opportunities for them.

What is your forecast for the transatlantic air cargo market, particularly for routes connecting Europe with the U.S. Pacific Northwest over the next few years?

I am very optimistic. I foresee sustained growth, driven by the increasing demand for direct, specialized routes that bypass the traditional, congested hubs. The Pacific Northwest is a booming economic region, and as supply chains become more sophisticated, shippers will increasingly prioritize speed and reliability. Services like this new Rome-Seattle connection are perfectly positioned to capture that demand. We’ll see this corridor become more vital not just for high-end consumer goods and industrial parts from Europe, but also for perishables and technology exports from the U.S. heading the other way. This route is at the forefront of a strategic shift toward more efficient, point-to-point global logistics.