In an era where global supply chains face relentless pressure from e-commerce booms and labor constraints, logistics robots have emerged as a transformative force, redefining efficiency with cutting-edge automation. As of 2025, the market stands at a robust $17.2 billion, poised for explosive growth to $72.6 billion by 2034, driven by a staggering 17.3% Compound Annual Growth Rate (CAGR). This seismic shift signals a future where robotic systems are not just tools but cornerstones of supply chain resilience. This analysis delves into the current dynamics, key trends, and regional disparities shaping this industry, offering a detailed forecast of how logistics robots will redefine operational paradigms over the next decade. The focus is on understanding the data, innovations, and challenges that will propel this market forward, providing actionable insights for stakeholders navigating this automated frontier.

Market Overview: The Robotics Surge in Logistics

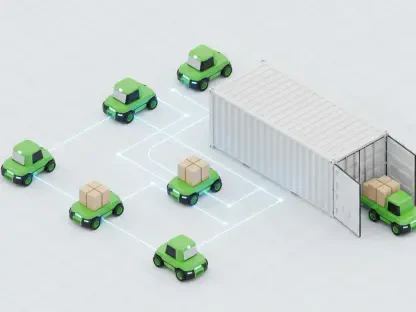

The logistics robots market is a critical segment of supply chain automation, encompassing technologies like Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), and robotic arms designed for tasks such as picking, packing, and transportation. These systems address the escalating demands of modern commerce, particularly in e-commerce, retail, and healthcare sectors, where speed and precision are paramount. With a current valuation of $17.2 billion in 2025, the industry reflects a rapid evolution from manual processes to machine-driven solutions, spurred by the need to mitigate labor shortages and optimize costs.

This growth trajectory is underpinned by technological advancements in Artificial Intelligence (AI) and the Internet of Things (IoT), which enable robots to adapt to complex, dynamic environments. The push for sustainability also plays a pivotal role, as energy-efficient systems align with global carbon reduction goals. Beyond technology, structural shifts in global trade and consumer behavior—such as the 30% annual e-commerce growth in certain regions—continue to fuel demand for robotic solutions that can handle massive order volumes with minimal errors.

However, the market is not without its hurdles. High initial investment costs and a shortage of skilled personnel to manage these advanced systems pose significant barriers, especially for small and medium-sized enterprises (SMEs). Despite these challenges, innovative models like Robotics as a Service (RaaS) are democratizing access, allowing businesses to adopt automation without prohibitive upfront expenses. This sets the stage for a deeper exploration of the trends and data driving this transformative market.

Key Trends and Projections: Shaping the Future of Logistics Automation

Technological Innovations Fueling Growth

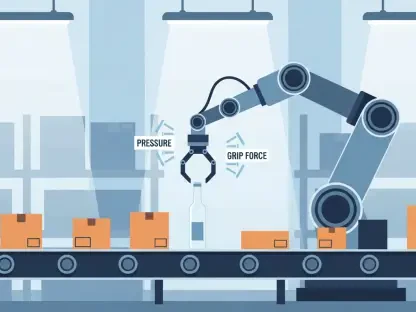

A dominant force in the logistics robots market is the integration of AI and IoT, which equips systems with real-time decision-making and predictive maintenance capabilities. As of 2025, AMRs hold a commanding 44.5% market share, with projections indicating a 17.9% CAGR through 2034, thanks to their flexibility and advanced vision systems. These technologies enable robots to navigate warehouses autonomously, slashing downtime and boosting picking accuracy to over 99%, as evidenced by deployments in high-traffic micro-fulfillment centers.

Moreover, the rise of collaborative robots—designed to work safely alongside humans—marks a significant shift toward hybrid warehouse models. These systems enhance adaptability in dynamic settings, addressing safety concerns while maintaining productivity. The ongoing market consolidation, exemplified by major acquisitions like Rockwell Automation’s $600 million purchase of Clearpath Robotics, points to a future of integrated automation platforms that streamline operations across hardware and software components.

Looking ahead, the emphasis on sustainability is reshaping robotic design, with energy-efficient models gaining traction amid corporate and regulatory pushes for greener logistics. This trend aligns with broader environmental goals, positioning robotics as a key player in reducing the carbon footprint of supply chain operations. The convergence of these innovations suggests that by 2034, logistics robots will be integral to creating smarter, more sustainable warehouses.

E-commerce and Labor Dynamics as Market Catalysts

The explosive growth of e-commerce remains a primary driver, with the segment valued at $5.7 billion as of recent data, reflecting its critical role in necessitating robotic solutions for rapid order fulfillment. Systems like those deployed in major distribution hubs have reduced click-to-ship times dramatically, setting new benchmarks for efficiency. This demand is particularly acute in regions experiencing rapid online retail expansion, where logistics infrastructure must keep pace with consumer expectations for same-day delivery.

Simultaneously, labor market challenges continue to accelerate automation adoption. Structural shortages, compounded by geopolitical factors and post-pandemic disruptions, have made manual operations increasingly untenable. Robotic deployments have proven effective in mitigating these issues, enabling 24/7 operations and freeing up human resources for higher-value tasks. For instance, certain implementations have recouped investments within two years by reducing reliance on full-time staff for repetitive tasks.

Yet, the transition to automation is not seamless. The lack of skilled technicians to operate and maintain these systems remains a bottleneck, particularly for smaller firms. Emerging solutions like RaaS offer a viable path forward, providing access to cutting-edge technology without the burden of capital expenditure, thus broadening the market’s reach across diverse business scales by 2034.

Regional Disparities and Growth Opportunities

The adoption of logistics robots varies significantly across regions, reflecting differences in infrastructure, policy, and economic priorities. North America, led by the United States with a dominant revenue share, showcases high growth potential despite relatively low current penetration, thanks to strong technological ecosystems and supportive government initiatives. This region is poised to see substantial expansion as more businesses recognize the long-term benefits of automation.

In contrast, Asia Pacific emerges as the fastest-growing market, driven by massive e-commerce demand and state-backed automation initiatives. China, holding a significant 41% share, exemplifies this trend with facilities that sort thousands of packages hourly using robotic systems, achieving near-perfect accuracy. Other countries in the region, like India, are also ramping up adoption through digitalization efforts and manufacturing growth, signaling robust opportunities over the next decade.

Europe, with Germany at the forefront, leverages its industrial automation heritage and Industry 4.0 investments to drive a steady 15.3% CAGR. Meanwhile, emerging markets in Latin America and the Middle East & Africa present untapped potential tied to infrastructure development and economic diversification. These regional nuances highlight the need for tailored strategies to maximize the impact of logistics robots, ensuring that solutions address local challenges like cost sensitivity and digital readiness by 2034.

Market Data and Forecast: A Closer Look at the Numbers

Delving into the data, the logistics robots market’s projected growth from $17.2 billion in 2025 to $72.6 billion by 2034 underscores its transformative potential. The hardware segment, comprising robotic platforms and sensors, currently dominates with a 66% share, expected to grow at a 16.4% CAGR due to continuous innovations in energy systems. Software, while smaller in share, offers high-profit margins above 15%, making it a strategic focus for scalable integration with warehouse management systems.

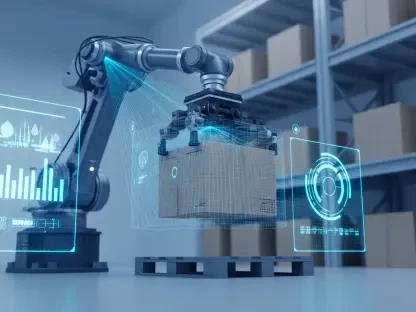

By application, transportation leads with a significant portion of the market, driven by intra-facility movement solutions, while pick-and-place applications are set to reach $6.8 billion by 2030, fueled by AI and computer vision advancements. End-use sectors like e-commerce and retail dominate, with the former benefiting from the urgent need for rapid fulfillment, and the latter accelerating adoption through omnichannel strategies. Other industries, including healthcare and automotive, are increasingly leveraging robots for precision and just-in-time operations.

Competitive dynamics reveal a concentrated landscape, with top players commanding a 42% share in recent figures, bolstered by innovation and strategic partnerships. The market’s future will likely be shaped by further consolidation and the rise of autonomous systems, with AMRs leading the charge. These projections indicate that by 2034, logistics robots will not only enhance operational efficiency but also redefine competitive benchmarks across global supply chains.

Reflecting on the Journey: Strategic Pathways Forward

Looking back, the analysis of the logistics robots market reveals a landscape defined by rapid growth, technological innovation, and regional diversity, with a clear trajectory toward a $72.6 billion valuation by 2034. The examination of trends like AI integration, e-commerce-driven demand, and sustainability underscores the profound impact of automation on supply chain efficiency. Challenges such as high costs and skill shortages are evident, yet solutions like RaaS emerge as critical enablers for broader adoption.

For businesses, the path ahead involves prioritizing scalable robotic solutions tailored to regional and sector-specific needs. Investing in workforce training to bridge skill gaps proves essential, as does aligning automation strategies with environmental goals to meet regulatory and consumer expectations. Starting with pilot projects in high-traffic operations and leveraging data analytics to measure return on investment offers practical entry points for many firms.

Beyond immediate actions, the focus shifts to fostering partnerships with technology providers to access flexible financing and cutting-edge systems. As the market continues to evolve, staying agile in response to regulatory shifts around data privacy and robot safety becomes a strategic imperative. These steps ensure that organizations not only adapt to the robotic revolution but also position themselves as leaders in a future where automation is synonymous with supply chain success.