The logistics automation market is undergoing transformative growth, driven by escalating demands for efficient supply chain solutions and rapid technological advancements. As we look towards 2032, the market, currently valued at USD 33.32 billion, is projected to surge to USD 91.58 billion, representing an impressive compound annual growth rate (CAGR) of 11.93%. Businesses across various sectors are increasingly recognizing the potential of logistics automation to streamline their operations, enhance productivity, and cut down on costs. This article explores the key facets of how logistics automation will reshape supply chain efficiency over the next decade.

Rising Demand for Efficiency and Accuracy

E-commerce is revolutionizing the way businesses operate, pushing the boundaries of logistics and supply chain management. The need for rapid and precise product delivery is paramount, and this demand is fueling the adoption of automated logistics solutions. These technologies streamline various aspects of the supply chain, significantly cutting down operational costs and slashing delivery times. Inventory management becomes more reliable through automation, ensuring stock levels are accurately monitored and products are efficiently stored.

Advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and robotics form the bedrock of this transformation, enabling more predictive and analytical capabilities within supply chains. The rise of e-commerce, coupled with consumer expectations for faster delivery, has led to innovative solutions that boost efficiency. Robotics, for instance, handle repetitive tasks, allowing human workers to focus on more complex activities. IoT devices offer real-time tracking, enhancing visibility across the supply chain and ensuring that goods are delivered promptly.

Automation in logistics is not just about speed; it’s also about precision and minimizing errors. AI-powered systems can make predictive analyses, optimize routes, and even foresee potential disruptions, thereby enabling proactive measures that maintain smooth operations. The cumulative effect of these technologies is a streamlined supply chain that ensures products are delivered faster, at lower costs, and with fewer errors.

Technological Integration and Advancements

Technological integration sits at the heart of logistics automation’s potential. AI-powered systems optimize routing and improve decision-making capabilities, making supply chains more efficient and responsive. Robotics handle repetitive and physically demanding tasks, mitigating human error and increasing workplace safety. The role of AI in logistics extends beyond mere automation; it encompasses the ability to analyze vast amounts of data for better decision-making and operational optimization.

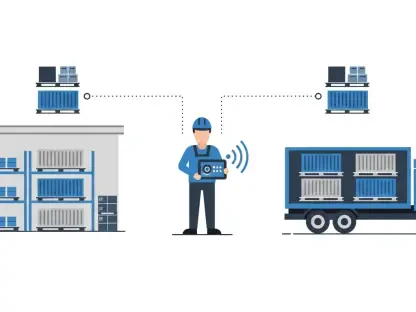

IoT devices provide real-time tracking, offering unparalleled visibility across the supply chain. Sensors and connected devices communicate seamlessly, ensuring that goods are in the right place at the right time, enhancing overall supply chain responsiveness. The integration of these technologies means that businesses can have end-to-end visibility, something that was difficult to achieve in traditional logistics setups. This technological synergy is poised to deliver exceptional efficiency and reliability in logistics operations.

Another critical advancement is in the use of robotics. Autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) are being deployed to handle tasks such as picking, packing, and transportation within warehouses. These robots work alongside human employees to significantly boost productivity and accuracy. The predictive capabilities of AI also help in managing fleet operations, reducing idle times, and ensuring optimal utilization of resources. As these technologies become more advanced and accessible, their adoption will continue to rise, spurring further growth in the logistics automation market.

Challenges and Barriers to Implementation

Despite the promising advancements, significant challenges mar the widespread adoption of logistics automation. High initial investment costs remain one of the primary barriers, often deterring smaller businesses. Implementing these advanced systems requires substantial capital, which not every company can afford, highlighting the need for cost-effective solutions or financial support mechanisms. These costs are not only related to the purchase of hardware and software but also involve the expenses associated with integrating these systems into existing infrastructure.

Moreover, integration challenges abound. Merging new automation technologies with existing logistics infrastructure can disrupt current processes. Training the workforce to manage and operate these sophisticated systems is another hurdle, requiring both time and resources. The complexity of integrating different technologies into a cohesive system also poses a challenge, particularly for businesses that lack the technical expertise required for seamless integration.

Regulatory guidelines, or the lack thereof, further complicate the deployment of logistics automation technologies. An absence of uniform regulatory standards often leads to uncertainty, making it difficult for companies to fully invest in these technologies. Additionally, a shortage of trained professionals who can operate and maintain these advanced systems is a significant barrier. Addressing these challenges requires a concerted effort from industry stakeholders, policymakers, and educational institutions to create a supportive ecosystem conducive to the growth of logistics automation.

Market Segmentation: Hardware vs. Software

In 2023, the hardware segment dominated the market with a significant revenue share, particularly due to the adoption of Automated Storage and Retrieval Systems (ASRS). These systems are pivotal for efficient material handling and inventory management in large warehouses and distribution centers, reflecting their critical role in the logistics ecosystem. ASRS includes a variety of components such as storage racks, input/output systems, S/R equipment, and computer management systems, all of which contribute to streamlined operations and optimized storage solutions.

On the other hand, the software segment is forecasted to grow at a robust rate over the next decade. Warehouse Management Software (WMS) automates vital warehouse processes including inventory tracking, storage management, and workload planning. As businesses embrace digital transformation, the demand for such sophisticated software solutions is expected to surge. The growth of the software segment is driven by the increasing need for real-time data, analytics, and decision-making capabilities within warehouses and distribution centers.

WMS provides a comprehensive solution for managing warehouse operations, from receiving and put-away to picking and shipping. This software enables companies to optimize their storage space, automate routine tasks, and provide better visibility into their inventory levels. As a result, businesses can reduce costs, improve accuracy, and enhance customer service. The increasing complexity of supply chains and the growing volume of e-commerce transactions are likely to further drive the demand for advanced warehouse management software.

Regional Dynamics and Growth

North America has been at the forefront of logistics automation, thanks to early adoption of advanced technologies and substantial investments aimed at enhancing supply chain efficiency. The region’s booming e-commerce industry and strict regulatory frameworks further bolster the widespread adoption of automation solutions. Key players in the North American market have consistently shown a strong commitment to innovation, driving the development and implementation of cutting-edge logistics technologies.

Furthermore, government initiatives and policies aimed at promoting technological advancements in the supply chain sector have played a crucial role in the region’s dominance. Investments in research and development, coupled with partnerships between private and public sectors, have facilitated the growth of logistics automation in North America. As a result, the region continues to lead the global market, setting benchmarks for efficiency and productivity in supply chain operations.

Meanwhile, the Asia-Pacific region is anticipated to be the fastest-growing market. Rapid industrialization, urbanization, and the surge in e-commerce activities are key drivers. Countries like China, India, and Japan are making significant investments in their logistics infrastructure to cater to the increasing demand for faster and more reliable delivery services. The region’s large and growing population, coupled with an expanding middle class with higher disposable incomes, is likely to fuel the demand for efficient supply chain solutions.

Asia-Pacific is also witnessing substantial advancements in IoT and AI technologies, further accelerating the adoption of logistics automation. Governments in the region are actively promoting smart city initiatives and digital transformation, which are expected to have a positive impact on the logistics automation market. The rise of manufacturing hubs and the need for efficient distribution networks in the Asia-Pacific region underscore the critical role of logistics automation in meeting the growing demand for timely and accurate deliveries.

Key Market Players and Innovations

Major industry players such as Honeywell International Inc., Daifuku Co., Ltd., and KION Group AG are spearheading innovations in logistics automation. Recent developments include Honeywell’s Smart Flexible Depalletizer, which automates the unloading of products from pallets, and KION Group’s new autonomous mobile robots (AMRs) for material handling. These innovations underscore the industry’s commitment to enhancing operational efficiency and reducing manual labor.

Companies like Toyota Material Handling and Zebra Technologies are also expanding their product portfolios, introducing new automated guided vehicles (AGVs) and advanced warehouse execution systems (WES) to optimize order fulfillment processes. Toyota’s AGVs, for instance, are designed for heavy-duty logistics tasks, substantially improving efficiency in large warehouses. Zebra Technologies’ WES integrates seamlessly with existing warehouse management systems, providing a holistic approach to optimizing warehouse operations.

The focus on innovation is not just limited to hardware; software advancements are equally critical. Companies are developing AI-driven analytics platforms and IoT-enabled solutions to provide real-time insights and enhance decision-making capabilities. These technological innovations are expected to drive continued growth in the logistics automation market, as businesses seek to leverage advanced solutions to stay competitive and meet the increasing demands of their customers.

Future Trends in Logistics Automation

The logistics automation market is experiencing significant growth due to the rising need for efficient supply chain solutions and quick technological progress. Currently valued at USD 33.32 billion, the market is forecasted to reach a staggering USD 91.58 billion by 2032. This reflects a remarkable compound annual growth rate (CAGR) of 11.93%. Various industries are increasingly aware of the benefits logistics automation offers in streamlining operations, boosting productivity, and reducing costs.

As we look to the future, several areas will become central to this transformation. Robotics and artificial intelligence are set to play crucial roles. For instance, automated guided vehicles (AGVs) and drones are expected to revolutionize warehouse management and last-mile delivery. Machine learning algorithms will enhance predictive analytics, helping businesses foresee demand and manage inventories more efficiently.

Additionally, the adoption of Internet of Things (IoT) technology will offer real-time data collection and analysis, optimizing logistics routes and reducing delays. Blockchain technology will also make supply chains more transparent and secure, ensuring product authenticity and streamlined payment processes.

The integration of these technologies will not only address current logistical challenges but will fundamentally reshape the supply chain landscape. By investing in logistics automation, businesses are preparing to meet future demands head-on, making their operations more agile, resilient, and cost-effective. Over the next decade, logistics automation will be pivotal in defining the success of companies across multiple sectors.