With decades of experience navigating the complex intersections of global logistics and supply chain management, Rohit Laila offers a sharp perspective on the technological and political forces shaping international trade. Today, he unpacks the recent whirlwind of tariff threats and reversals between the United States and Europe, exploring the high-stakes diplomacy surrounding Arctic security, the tactical maneuvering of trade blocs, and the potential economic fallout for key industries caught in the crossfire.

President Trump cited a new framework deal with NATO as the reason for canceling tariffs. What might this framework entail regarding Greenland and the Arctic, and what specific steps would be needed to make it a reality, especially concerning the “Golden Dome” concept?

This framework is likely a diplomatic masterpiece of de-escalation, shifting the focus from the politically impossible—the U.S. purchasing Greenland—to the strategically feasible. Instead of a sale, we’re probably looking at a long-term lease or a special security arrangement that grants the U.S. expanded military and infrastructure rights necessary for its “Golden Dome” missile defense system. To make it a reality, the first step would be a formal agreement outlining U.S. operational authority, Danish sovereignty, and NATO’s oversight role. This would involve intense negotiations over land use, environmental impact, and the exact basing rights for the components of this conceptual defense shield. It effectively gives the U.S. the security foothold it desires without the inflammatory headline of annexation.

The EU voted to suspend a trade deal framework with the U.S. just hours before the White House canceled its planned tariffs. How do you assess the timing of these two events, and what does this sequence suggest about the diplomatic leverage each side holds?

The timing is far from coincidental; it’s a classic case of high-stakes geopolitical chess. The European Parliament’s decision to suspend the August trade framework was a calculated, pre-emptive strike. It sent a clear signal to Washington: “We will not negotiate under duress, and we have our own economic weapons to wield.” By putting a previously agreed-upon deal on ice, they demonstrated unity and resolve, significantly raising the cost of Trump’s Greenland gambit. Trump’s subsequent reversal, framed around the NATO deal, looks like a direct response. It suggests the EU’s action created a powerful incentive for the White House to find an off-ramp, and the talks with NATO Secretary General Mark Rutte provided the perfect, face-saving solution.

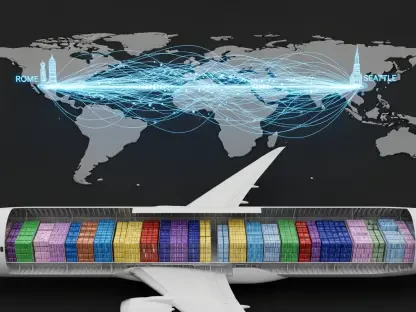

The now-canceled tariffs were set to hit eight specific European countries, escalating from 10% to 25%. Can you describe the potential economic impact on key industries in those nations, and what kind of contingency planning might have been underway before this week’s reversal?

The impact would have been immediate and severe. We’re talking about a broadside against some of Europe’s most vital economic engines. For Germany, a 25% tariff on “any and all goods” would have been catastrophic for its automotive and manufacturing sectors. French luxury goods, Dutch agricultural products, and Swedish industrial machinery would have suddenly become uncompetitive. In the weeks leading up to this, you can bet that companies were in crisis mode. They would have been accelerating shipments to get goods into the U.S. before February 1, frantically seeking alternative markets, and preparing for the grim reality of absorbing costs or passing them on to American consumers, leading to a lose-lose scenario. The sense of relief in corporate boardrooms across those eight nations must be palpable right now.

The trade framework suspended by the European Parliament involved a 15% U.S. tariff on EU cars and other goods. With that deal now on hold, what are the next steps for U.S.-EU trade relations, and what are the biggest sticking points to reviving the agreement?

That suspended deal is now in diplomatic limbo. The next step hinges on whether the EU sees Trump’s cancellation of the Greenland tariffs as a sufficient confidence-building measure to bring it back to the table. The sticking points that led to its creation haven’t vanished. The core of that agreement was a difficult compromise: the EU would grant access to its agricultural markets—a historically sensitive area—and lower industrial tariffs in exchange for clarity on U.S. automotive tariffs, which were capped at 15%. Reviving it will require rebuilding trust. Brussels will be wary of being put in this position again and will likely demand stronger assurances that U.S. trade policy won’t be tied to unrelated geopolitical demands in the future.

What is your forecast for the future of U.S. diplomatic relations with European allies, particularly concerning Arctic security and trade?

I forecast a period of cautious recalibration. This episode, while disruptive, has inadvertently clarified the boundaries for all parties. The U.S. now understands that outright territorial acquisition is a non-starter, but a security-focused arrangement in the Arctic is achievable through NATO. European nations have reaffirmed that their economic unity is a powerful defensive tool against unilateral pressure. In the near term, relations will be tense but pragmatic. Both sides need each other. The focus will likely shift toward implementing this new NATO framework for Arctic security, while trade negotiations will proceed slowly and deliberately, with a newfound European insistence on firewalls between economic policy and the president’s more ambitious geopolitical projects.