The abrupt dismantling of the $800 de minimis exemption has irrevocably altered the landscape of global e-commerce, creating a ripple effect that touches every corner of the logistics industry. This seismic policy shift, which took effect in 2025, has redefined the economics of cross-border shipping for countless businesses and impacts billions of dollars in trade annually. The following analysis dissects the statistical impact of this change, explores the strategic responses shippers are adopting, presents expert insights from the front lines, and forecasts the future of global commerce in this new regulatory era.

The New Reality Navigating a Changed Trade Landscape

The Statistical Impact of De Minimis Elimination

The scale of the previous system underscores the magnitude of the current disruption. In 2024 alone, the de minimis provision facilitated the entry of nearly 1.4 billion import shipments into the United States, representing a staggering $64.6 billion in goods value that bypassed standard duties and taxes. This long-standing exemption was a cornerstone of the direct-to-consumer import model, allowing for a frictionless flow of low-value goods.

The elimination of this trade tool sent immediate shockwaves through established supply chains. The policy change has directly contributed to significant disruptions in air cargo volumes, forced a complete overhaul of peak season planning, and placed immense pressure on the profit margins of retailers who had built business models around the exemption. These are not minor adjustments but symptoms of a fundamental realignment of U.S. import dynamics.

Evolving Shipper Strategies in Action

In response, successful shippers are pivoting from a model of speed and volume to one of precision and compliance. A heightened focus on data accuracy has become paramount for navigating the new customs environment. Companies are now required to provide 10-digit Harmonized System (HS) codes, detailed country of origin information, and excellent product descriptions for every inbound item, a level of detail that was previously unnecessary for de minimis shipments.

Protecting profitability has also become a central strategic pillar. Businesses are implementing dynamic pricing models informed by real-time landed cost data to ensure margins are not eroded by unforeseen duties and fees. Furthermore, many are collaborating with logistics providers to rightsize their U.S. inventory footprint, balancing the cost of holding domestic stock against the complexity of individual cross-border shipments.

A concurrent trend is the move toward SKU rationalization. To control escalating product costs and simplify the now more arduous customs clearance process, brands are strategically reducing their product catalogs. By focusing on a core selection of items, they can better manage compliance requirements and maintain a more predictable cost structure in this less forgiving trade environment.

Expert Perspectives Voices from the Front Lines of Logistics

Industry leaders stress that data mastery is non-negotiable in this new paradigm. Maia Benson, Chief Business Officer at FlavorCloud, emphasizes that “data, data, data is going to be required of all inbound shippers,” regardless of their size. Benson also advises businesses to aggressively “protect your margins” by developing a deep understanding of landed costs and using that intelligence to inform pricing and inventory strategies.

Navigating the complexities of the U.S. tariff schedule now requires specialized expertise. Darby Meegan, General Manager of Omnichannel at Flexport, highlights the critical need to engage a trusted customs partner, especially for brands entering the U.S. market through standard customs flows for the first time. Such partners can help ensure compliance and prevent overpayment of duties.

The consensus among experts is that operational efficiency is key to survival. Companies are advised to negotiate for optimal shipping rates and densify their supply chains to “squeeze” out every possible cost. Meegan notes that building this kind of operational intelligence will yield “huge dividends,” transforming a regulatory burden into a competitive advantage for those who adapt effectively.

The Future of Cross-Border E-Commerce

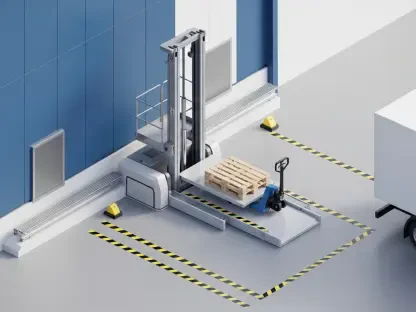

The long-term evolution of global shipping is likely to include a structural shift toward more domestic or nearshore warehousing. By holding inventory closer to the end consumer, companies can significantly reduce customs friction and improve delivery times, though this comes with its own set of inventory carrying costs and logistical considerations.

Despite the challenges, this trend could yield significant benefits. The heightened data requirements are forcing greater supply chain transparency, providing businesses and consumers with more visibility into product origins and journeys. Moreover, the elimination of the exemption helps create a more level competitive playing field for domestic retailers who were previously at a disadvantage.

However, persistent challenges remain. Consumers will likely face higher landed costs, and the increased logistical complexity poses a significant hurdle for small and medium-sized sellers. There is also an ongoing risk that new customs bottlenecks could emerge as agencies adapt to the increased volume of fully-dutiable shipments. This trend will continue to shape U.S. trade policy and compel companies to build more resilient and intelligent global supply chains.

Conclusion: Adapting to the New Paradigm

The elimination of the de minimis provision was a permanent and transformative shift for global trade, one that demanded immediate and strategic adaptation from all participants. The initial shockwaves have now settled into a new reality where the old rules no longer apply.

The core pillars for success that emerged in the post-de minimis world were clear: data mastery, vigilant margin protection, strategic partnerships, and a relentless drive for supply chain optimization. The companies that thrived were those that viewed this regulatory challenge not as a barrier, but as an opportunity to innovate and build more efficient, transparent, and resilient global operations for the years to come.