Unraveling the Complexity of Supply Chain Challenges in Consumer Goods

Imagine a major consumer goods company facing a sudden 14-day delay in shipments to Europe due to unexpected rerouting in the Red Sea, with costs spiking by 30% overnight, a scenario all too common in 2025. This situation underscores the fragile nature of global supply chains in an era marked by geopolitical tensions and environmental disruptions. The consumer goods industry stands at a critical juncture where managing risks during logistics transitions and achieving operational efficiency are not just goals but necessities for survival. This guide aims to equip industry professionals with actionable strategies to navigate these challenges, ensuring resilience amid a volatile landscape.

The importance of mastering supply chain risks cannot be overstated, especially as external pressures mount. Geopolitical conflicts, regulatory shifts, and climate-related crises like droughts impacting key trade routes have amplified vulnerabilities for companies reliant on seamless logistics. Beyond mere disruption, these factors threaten brand reputation, financial stability, and customer trust. This guide delves into practical steps to mitigate such risks, offering a roadmap for firms to adapt and thrive under pressure.

By focusing on logistics partner transitions and efficiency, consumer goods companies can turn challenges into opportunities for growth. The following sections provide a detailed framework for understanding the current environment, implementing targeted strategies, and building long-term resilience. From compliance audits to digital transformation, the insights shared aim to empower decision-makers to safeguard operations against unpredictable global forces.

The Evolving Landscape of Consumer Goods Logistics

Supply chain dynamics in the consumer goods sector have undergone significant transformation, shaped by a history of globalization now tested by contemporary disruptions. Over recent years, external events have exposed the fragility of interconnected networks, with issues like U.S.-China trade tensions creating tariffs and restrictions that ripple through markets. Combined with environmental challenges, such as a 40% capacity reduction at the Panama Canal due to drought, companies face unprecedented obstacles in maintaining smooth operations.

Current global conditions further complicate the logistics landscape, with rerouting through conflict zones like the Red Sea adding 7 to 14 days to European shipments. Regulatory changes, such as the EU’s Corporate Sustainability Due Diligence Directive, impose stricter compliance demands, increasing the risk of penalties for non-adherence. These factors collectively drive up costs and delay deliveries, pushing firms to rethink traditional supply chain models in favor of more adaptive approaches.

The real-world implications of these disruptions highlight why proactive risk management is essential. Beyond financial losses, delays and capacity constraints erode customer confidence and strain retailer relationships. As logistics transitions become inevitable for many seeking better partners or cost savings, the urgency to address vulnerabilities during these changes grows. Companies must prioritize strategies that anticipate and counteract such challenges to ensure sustained competitiveness.

Key Strategies for Mitigating Risks in Logistics Transitions

Navigating supply chain risks requires a structured approach, particularly during logistics partner transitions and in the pursuit of operational efficiency. The following steps outline critical strategies to address specific challenges, from compliance pitfalls to technological gaps. Each method is designed to build a robust framework for minimizing disruptions and enhancing resilience.

These strategies focus on practical solutions tailored to the unique pressures of the consumer goods sector. By addressing vulnerabilities head-on, companies can safeguard against costly delays and penalties while optimizing performance. Detailed below are actionable steps to guide firms through this complex terrain.

Step 1 – Assessing Risks During Partner Transitions

Logistics partner transitions often expose companies to significant vulnerabilities, including compliance failures and operational blind spots. A stark example involves a U.S. company incurring a $12 million fine for tariff fraud due to shipment misclassification during such a change. These incidents reveal how easily errors can escalate into major financial and reputational damage without proper oversight.

To mitigate these risks, thorough preparation and monitoring are indispensable. Companies must anticipate potential gaps in communication or data accuracy that arise when switching partners. Implementing rigorous checks and maintaining transparency during handovers can prevent misunderstandings that lead to costly mistakes.

Prioritizing Compliance Audits

Conducting comprehensive compliance audits before and during logistics transitions is a critical safeguard against legal and financial repercussions. These audits should scrutinize tariff classifications, import/export documentation, and adherence to regional regulations to ensure no detail is overlooked. By identifying discrepancies early, firms can avoid penalties that could derail operations.

Regular audits also foster a culture of accountability with new partners, setting clear expectations from the outset. Engaging third-party experts for unbiased assessments can provide additional assurance, especially in navigating complex international laws. This proactive stance helps maintain trust with stakeholders while protecting the bottom line.

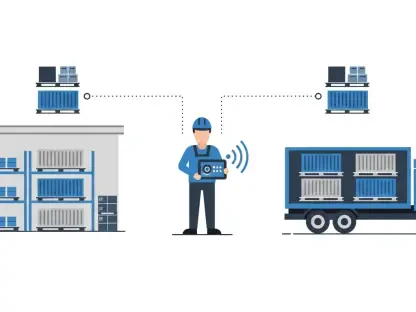

Enhancing Supply Chain Visibility

Real-time tracking tools are essential for eliminating operational blind spots during partner transitions. Visibility into shipment status, inventory levels, and potential bottlenecks allows companies to respond swiftly to emerging issues. Investing in platforms that integrate with logistics partners’ systems ensures seamless data flow across the supply chain.

Beyond technology, fostering open communication with partners enhances transparency at every stage. Establishing shared dashboards or reporting mechanisms can bridge gaps that often emerge during handovers. Such measures empower firms to maintain control over operations, even amid significant changes.

Step 2 – Driving Efficiency with Digital Transformation

Technology serves as a powerful ally in countering supply chain disruptions, offering tools to streamline processes and reduce costs. Success stories abound, such as Amazon achieving a 20% cost reduction through AI-driven fulfillment systems. Similarly, DHL improved delivery times by 25% using predictive analytics, demonstrating the tangible benefits of digital adoption.

Embracing these innovations requires a strategic shift in mindset, prioritizing long-term gains over short-term expenses. Digital tools not only enhance efficiency but also provide data-driven insights to anticipate market shifts. For consumer goods companies, this means faster response times and better alignment with customer demand.

Investing in AI and Automation

AI and automation stand at the forefront of optimizing supply chain operations, particularly in fulfillment and inventory management. These technologies can predict demand fluctuations, automate routine tasks, and reduce human error, leading to significant cost savings. Implementing such systems positions companies to handle peak seasons with greater agility.

Scalability is a key consideration when adopting AI solutions, ensuring they can grow with business needs. Pilot programs targeting specific pain points, like warehouse bottlenecks, offer a low-risk way to test effectiveness before full deployment. This measured approach maximizes return on investment while minimizing disruption.

Adopting Collaborative Forecasting Models

Collaborative forecasting, exemplified by Procter & Gamble’s use of Collaborative Planning, Forecasting, and Replenishment (CPFR), minimizes stockouts and overstock through shared data with partners. This method aligns production and inventory with real-time market needs, reducing waste and improving service levels. It fosters stronger relationships across the supply chain.

Implementing such models requires trust and data integration among stakeholders, often necessitating initial workshops to align goals. Cloud-based platforms can facilitate this collaboration, providing a centralized space for updates and adjustments. Over time, these efforts lead to more accurate predictions and streamlined operations.

Step 3 – Building Resilience Through Diversification

Strategic reconfiguration through diversification offers a buffer against global disruptions, as seen in Apple’s supplier diversification during the COVID-19 crisis. By spreading reliance across multiple regions and partners, companies can mitigate the impact of localized issues like trade disputes or natural disasters. This approach is a cornerstone of modern supply chain resilience.

Diversification, however, demands careful planning to avoid overextending resources or compromising efficiency. Balancing geographic spread with operational coherence is essential to maintain cost-effectiveness. The following considerations provide guidance for implementing this strategy effectively.

Balancing Cost with Regionalization

Nearshoring to regions like Mexico reduces exposure to volatile areas while managing transportation expenses. This strategy shortens lead times and lowers the risk of delays caused by distant supply hubs. For many firms, regionalization offers a practical compromise between cost and risk mitigation.

Evaluating potential nearshore partners involves assessing infrastructure, labor costs, and regulatory environments. Pilot projects in select markets can test viability before full commitment, ensuring alignment with broader business objectives. This gradual shift helps preserve financial stability during transitions.

Overcoming Resource Constraints for Smaller Firms

Smaller companies often face significant hurdles in adopting diversification strategies due to limited capital and expertise. Unlike larger counterparts, they may struggle to establish multiple supplier relationships or invest in regional hubs, leading to inventory imbalances. Tailored solutions are necessary to level the playing field.

Leveraging industry consortia or shared logistics networks can provide access to diversified resources without the full burden of cost. Additionally, focusing on incremental changes, such as dual-sourcing for critical components, offers a feasible starting point. These scalable alternatives enable smaller players to build resilience over time.

Core Takeaways for Effective Risk Management

Managing supply chain risks in consumer goods logistics demands a multifaceted approach, distilled into key actionable points for quick reference. Conducting compliance audits and ensuring visibility during logistics transitions are fundamental to avoiding legal and operational pitfalls. These measures lay the groundwork for seamless partner changes.

Embracing digital tools like AI, automation, and predictive analytics drives efficiency gains, enabling cost reductions and faster delivery times. Pursuing diversification through nearshoring and multishoring further buffers against global disruptions, while tailoring strategies to company size addresses resource disparities. Together, these principles form a robust defense against supply chain vulnerabilities.

Future Implications and Industry Trends in Supply Chain Resilience

The strategies outlined align with broader industry shifts toward dynamic, immune-inspired supply chains, as advocated by leading consultancies. This evolution prioritizes adaptability, allowing companies to reconfigure operations swiftly in response to crises. Sustainability and regionalization emerge as central themes, driven by regulatory pressures and market expectations.

Technological innovation continues to shape the future, with AI and cloud platforms becoming indispensable for competitiveness. However, challenges persist, particularly for smaller firms grappling with digital infrastructure gaps. Stricter regulatory penalties also loom, underscoring the need for compliance readiness across all scales of operation.

Opportunities abound for investors to support companies embracing adaptive models and ESG-aligned practices. Firms demonstrating agility and transparency in supply chain management are likely to attract capital, as resilience becomes a marker of long-term value. Staying ahead of these trends positions stakeholders to navigate emerging risks effectively.

Charting the Path Forward in Consumer Goods Logistics

Looking back, the journey through mitigating supply chain risks revealed a landscape fraught with challenges but rich with solutions. Strategic planning, from compliance audits to diversification, proved essential in safeguarding operations against disruptions. Technology adoption, particularly AI and automation, emerged as a transformative force, driving efficiency where traditional methods fell short.

Reflecting on these efforts, the next steps involve a deeper commitment to resilience through ongoing investment in digital frameworks. Companies that prioritize robust compliance and adaptive models gain a competitive edge, setting a precedent for others to follow. For investors, backing firms with strong technological and regulatory foundations becomes a clear path to sustainable returns.

As the industry moves forward, the focus shifts to continuous assessment of supply chain vulnerabilities. Exploring partnerships for shared resources offers a practical avenue for smaller players, while larger entities expand regional footprints. This proactive stance ensures that consumer goods logistics evolves into a domain of agility, ready to withstand future uncertainties with confidence.