In recent years, the parcel delivery industry has undergone considerable transformation, chiefly driven by Amazon’s aggressive expansion into logistics. This evolution encompasses both technological advances and economic shifts, profoundly affecting traditional carriers such as UPS and the operational dynamics within the sector. With Amazon spearheading significant changes, a narrative emerges that encapsulates the challenges faced by existing logistical firms, the influence of economic policies, and the evolving labor landscape. Against this backdrop, this article delves into the multifaceted transition of the industry, exploring Amazon’s rise, competitive innovations, UPS’s strategic adjustments, and external factors influencing the delivery ecosystem.

Amazon’s Rise in Parcel Delivery

Dominance in Market Share

Amazon has transitioned from being a peripheral player in the parcel delivery sector to a dominant force, managing an extensive portion of deliveries. This metamorphosis underscores Amazon’s strategic ambition to internalize logistics operations, thereby minimizing reliance on traditional carriers such as FedEx and UPS. This move is not merely a logistical advantage but represents a calculated effort to reshape how parcels are managed and delivered, reflecting Amazon’s aspiration to drive efficiency and customer satisfaction. By taking control of logistics, Amazon has concurrently generated new industry standards, which emphasize rapid and dependable delivery services.

Through managing a significant share of the total parcels, Amazon has demonstrated its capability to adapt quickly, aligning logistical operations with broader corporate objectives. The direct impact on market dynamics has been profound, compelling existing firms to reevaluate their strategies, given Amazon’s encroaching footprint. The transformation has showcased the potential for an intricate network capable of delivering swift and satisfactory customer experiences, fundamentally disrupting established market conventions. With Amazon’s continued focus on expanding operational breadth, it remains poised to redefine industry benchmarks and maintain a competitive edge in logistics.

In-House Logistics and Innovation

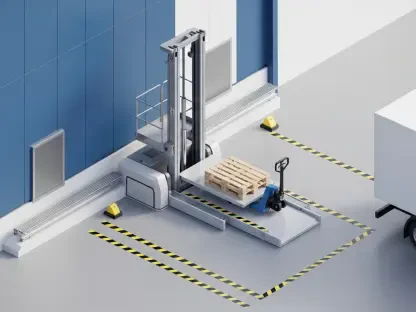

The ongoing evolution of Amazon’s logistics strategy has also been marked by a notable shift toward in-house solutions, setting new precedents for innovation and efficiency. By developing a dedicated delivery network, Amazon has substantially reduced operational costs and increased control over the entire logistics process. This approach reflects a broader industry trend where companies aim to internalize logistics to optimize performance metrics and customer satisfaction. The emphasis on in-house solutions has further reinforced Amazon’s role as a disruptor, prompting traditional carriers to innovate or face declining market relevance.

The commitment to innovation is evident through Amazon’s continuous advancements in delivery technology, including automation and logistics software. These innovations are instrumental in driving faster delivery times, enhancing reliability, and providing greater transparency throughout the delivery cycle. Customers benefit from real-time tracking and updates, further setting Amazon apart in the competitive landscape. Consequently, Amazon’s inclination towards in-house logistics and cutting-edge innovations challenges existing carriers to reconsider their operational frameworks, adapting to meet a standard now shaped by Amazon’s logistics prowess.

Competitive Forces Reshaping the Industry

Pricing Dynamics and Innovation

The parcel delivery industry is currently experiencing unprecedented competition and pricing dynamics driven by new entrants and innovative pricing strategies. The rise of alternative carriers who offer competitive rates is reshaping the landscape traditionally dominated by established firms like USPS, FedEx, and UPS. With revenue per parcel seeing a decline, traditional carriers are compelled to innovate, introducing low-cost services that cater to growing demand for affordability without compromising quality. This competitive environment underscores a strong trend toward cost-effectiveness, reminiscent of the wider consumer demand for budget-conscious solutions.

USPS exemplifies this shift with its Ground Advantage service, which has markedly increased parcel volumes while offering a more affordable shipping option. This response to market pressures highlights the critical need for carriers to adapt to consumer expectations, balancing economic viability with high-quality service offerings. The increased competition has led to a significant recalibration of pricing strategies, urging larger carriers to adopt innovative solutions to maintain market position. Against this backdrop, the industry is witnessing rapid adaptation as companies strive to meet the evolving demands of both business clients and individual customers.

Impact on Traditional Carriers

The evolving pricing dynamics pose notable challenges for traditional logistics companies as they endeavor to balance superior service quality with competitive rates. Larger carriers, once dominant players in the market, find themselves at a crossroads, prompted to reevaluate their business models and strategic priorities amidst heightened competition. The need to offer services that maintain excellence while remaining economically viable has become increasingly pressing. UPS and FedEx, for instance, are compelled to undertake operational adjustments and investment in technology to improve efficiency and cost-effectiveness.

These shifts are reflected in the operational strategies of traditional carriers, who are investing in technology and process optimization to reduce overheads and better compete with emerging solutions. The necessity to adapt to these competitive forces has catalyzed a period of introspection and innovation, as these companies work to align pricing with market expectations. The implications are multifold, including changes in business engagements, collaboration strategies, and adaptation to consumer-led demands, precipitating substantial transformations within the industry landscape that are crucial for sustaining competitive edge.

UPS’s Operational Adjustments

Response to Volume Declines

UPS has been at the forefront of adapting to declining parcel volumes and a reassessment of its partnership with Amazon, resulting in significant operational adjustments. The decision to recalibrate operations, including the closure of numerous facilities and the reduction of its workforce, stems from a strategic focus on profitability over volume driven by singular customers. By withdrawing from certain volumes associated with Amazon, UPS aims to target more profitable avenues and bolster its financial standing through strategic efficiency initiatives.

The scaling back of operations tied to Amazon reveals a broader strategic redirection within UPS, focusing on optimizing existing resources to drive profitability. This recalibration also demonstrates UPS’s agility in navigating market shifts and responding to external pressures that influence operational capacity. The commitment to enhancing core offerings while minimizing revenue dependence on less profitable channels is emblematic of a strategic endeavor to sustain UPS’s market position. By prioritizing profitable segments and improving operational efficiencies, UPS undertakes a comprehensive approach toward redefining its corporate trajectory amidst challenging market dynamics.

Automation and Labor Strategies

A significant facet of UPS’s strategic operational shift has been the emphasis on automation to address rising labor costs and enhance efficiency. The integration of advanced technologies across its facilities highlights UPS’s commitment to mitigating the impacts of substantial labor contracts and spiraling compensation commitments. The focus on automation seeks to streamline operations, reducing reliance on manual processes and alleviating pressures induced by labor-driven overheads, further integrating technological solutions into core business functions.

Labor agreements, such as those with the Teamsters union, have resulted in increased operational costs due to commitments like increased compensation for drivers. UPS’s strategic trajectory involves extensive automation efforts aimed at offsetting these costs and improving long-term sustainability. By investing in automation, UPS aims to drive productivity and efficiency, optimizing operational workflows and related costs. These efforts reflect a comprehensive strategy that recognizes the inherent challenges posed by labor dynamics, affirming UPS’s direction towards technological advancement to sustain competitive edge. The continual commitment to automation and labor efficiency embodies a strategic adjustment pivotal in aligning UPS’s broader operational goals amid evolving industry pressures.

External Economic Influences

Tariffs and Cross-border Challenges

The imposition of tariffs and the resulting complexities in cross-border shipment dynamics have introduced new challenges and opportunities within the package delivery industry. Economic policies have led to increased costs for international shipping, mandating carriers to navigate fluctuating geopolitical landscapes while seeking cost-effective solutions. This intricate environment provides niche opportunities for emergent regional players specializing in final-mile delivery services and region-specific solutions, catering to localized demands with tailored approaches.

The intricate interplay between tariff-related challenges and carrier strategies underscores the industry’s adaptability in the face of economic shifts. Established carriers, faced with increased international shipping complexities, have turned toward innovative strategies that leverage technology to maintain service quality and pricing balance. Furthermore, this evolving landscape has necessitated a strategic reevaluation of cross-border logistics, as carriers work to ensure compliance with tariff regulations while bolstering market presence through innovation. The opportunities presented by the current environment highlight a growing landscape where specialized, adaptable players play an increasingly vital role.

Broader Economic Concerns

Broader economic factors, such as labor cost volatility and geopolitical shifts, have been instrumental in driving changes throughout the parcel delivery sector. These dynamics compel carriers to navigate uncertainties while investing in technology to maintain competitiveness. The fluctuating nature of labor costs and the evolving geopolitical environment necessitate strategic investments and innovative approaches to sustain operational efficacy. Carriers are compelled to embrace technological advancements to enhance services, mitigate costs, and foster resilience in a changing economic climate.

These economic challenges are mirrored in the industry’s continual evolution towards incorporating technology solutions that align with consumer expectations and policy-driven costs. Companies are actively adapting, leveraging technological tools to optimize logistics operations and remain competitive amid uncertainties. As economic variables persist, the necessity for carriers to align service offerings with market realities becomes increasingly evident, underscoring the sector’s ability to navigate challenges and leverage opportunities presented by broader economic conditions. This adaptability and resilience define the industry’s capacity to balance economic pressures with operational advancements.

Labor Relations and Corporate Strategy

Union Dynamics at UPS

The intricate labor relations within UPS, particularly those involving the Teamsters union, are emblematic of the challenges faced by the company amidst operational realignments and union dynamics. With labor agreements emerging as pivotal concerns, UPS operates within a delicate balance, seeking to align corporate goals with contractual obligations. Tensions arise as UPS engages in negotiations with unions demanding job security and employment terms while the company pursues automation strategies that may clash with union interests. The ongoing labor dynamics highlight the complexities involved in aligning corporate imperatives with worker rights, a recurring theme in UPS’s strategic agenda.

UPS’s engagement with its unionized workforce exemplifies the broader industry challenge of reconciling operational advancements with labor demands. The potential conflict between automation initiatives and union demands showcases the intricacies inherent in operational realignments that UPS faces. These dynamics reflect a broader tension between maintaining workforce levels and optimizing operations through innovation, underscoring UPS’s need to navigate complex labor relations while striving for operational efficiency. The interplay between labor agreements and corporate strategy remains a critical aspect that influences UPS’s trajectory and guides its interactions with unionized entities.

Corporate Focus on Profitability

The corporate strategy of UPS, particularly its emphasis on profitability and shareholder returns, is evident through various financial maneuvers such as stock buybacks and dividend declarations. This overarching focus on maximizing wealth is highlighted by strategic prioritization aimed at enhancing shareholder value, while simultaneously grappling with internal cost dynamics induced by labor agreements and market pressures. UPS’s commitment to extracting corporate wealth highlights its strategic prioritization while balancing these initiatives with operational objectives.

The strategic alignment of UPS’s corporate goals with profitability underscores its strategic prioritization aimed at enhancing shareholder value. The implications of this approach represent a nuanced interplay between corporate priorities and labor dynamics, emphasizing UPS’s comprehensive engagement in aligning financial priorities with operational goals. While focusing on shareholder returns remains central, UPS continues to balance these initiatives with operational objectives.

Conclusion

In recent times, the parcel delivery sector has witnessed considerable transformation, primarily driven by Amazon’s aggressive push into logistics. This shift includes both technological innovations and substantial economic changes, deeply impacting traditional carriers like UPS and the operational landscape of the industry. Against this backdrop, this article has explored the multifaceted transition of the industry, examining Amazon’s rise, competitive innovations, UPS’s strategic adjustments, and external factors influencing the delivery ecosystem. Technology has enabled faster and more efficient delivery capabilities, redefining customer expectations. Meanwhile, shifts in labor dynamics, often influenced by new economic policies and labor disputes, are also reshaping the workforce. This comprehensive exploration highlights both the challenges and the opportunities within this rapidly changing field.