A Strategic Pivot: Unpacking FedExs New Profit First Mantra

For decades, the logistics industry operated on a simple premise where more packages meant more success, but in a dramatic departure from this volume-centric model, FedEx is charting a new course. The company is intentionally shifting its focus from a “quantity” mindset to one centered on “quality,” a strategic pivot designed to bolster profit margins and drive sustainable earnings through 2029. This move signals a fundamental change not just for the shipping giant but for the entire logistics landscape. This analysis will explore the historical pressures that prompted this transformation, dissect the core components of FedEx’s new strategy, and analyze what this profit-over-volume approach means for the future of global supply chains.

The End of an Era: Moving Beyond the Volume at All Costs Model

To understand why FedEx is making this change, one must look at the industry’s recent past. The e-commerce boom, supercharged by the global pandemic, created an unprecedented surge in parcel volume. In response, major carriers, including FedEx, engaged in fierce competition to capture market share, often leading to price wars and a race to handle every possible shipment. While this approach drove top-line revenue, it came at a significant cost. Networks became strained, operating costs soared, and profit margins thinned considerably. The pursuit of volume at all costs proved to be unsustainable, forcing a moment of reckoning. It became clear that not all packages are created equal, and servicing lower-margin, high-maintenance shipments was diluting profitability and straining the very infrastructure that premium customers rely on.

The Blueprint for Profitable Growth

Targeting High Value Verticals: Quality Over Quantity in Action

The centerpiece of FedEx’s new strategy is a deliberate focus on high-margin business segments where customers prioritize service excellence over rock-bottom prices. In the business-to-business (B2B) arena, the company is targeting specialized verticals like healthcare, automotive, aerospace, and data centers. These industries depend on the precise, reliable, and often time-critical delivery of essential goods, from life-saving medical supplies to just-in-time manufacturing components. On the business-to-consumer (B2C) front, FedEx is narrowing its focus to the premium e-commerce market, serving brands and shoppers who demand faster delivery speeds and superior tracking capabilities. By concentrating on these niches, FedEx can leverage its network’s strengths to provide value-added services that command higher prices and yield healthier profits.

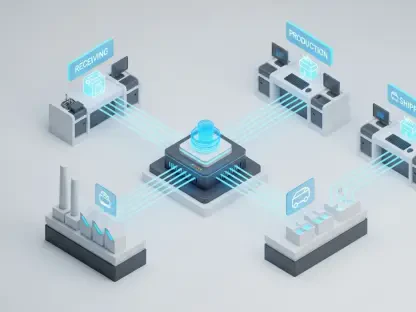

Building a Smarter Supply Chain: The One FedEx Transformation

This strategic realignment is more than just a change in customer focus; it is a fundamental overhaul of the company’s operational DNA. The shift is supported by four key corporate priorities: scaling digital and AI tools, modernizing its integrated air and ground networks, fully embedding its “One FedEx” operating model to eliminate internal silos, and accelerating growth in the high-margin verticals identified. As CEO Raj Subramaniam articulated, the goal is to combine the company’s vast physical network with digital intelligence. This synergy aims to create a more flexible, efficient, and intelligent supply chain that not only serves premium customers better but also drives profitable growth and delivers higher returns for stockholders.

Recalibrating Market Position: Risks and Competitive Dynamics

Pivoting away from a volume-first approach is not without its challenges. By de-emphasizing low-margin freight, FedEx risks ceding market share in the broader parcel delivery space to aggressive competitors like Amazon Logistics and even the U.S. Postal Service. The transition requires a delicate balance of shedding less profitable business without alienating valuable customers or creating service gaps. However, this move doesn’t exist in a vacuum. It mirrors a similar “Better, not Bigger” strategy employed by rival UPS, suggesting a broader industry trend toward rationalizing networks and focusing on profitability. FedEx is betting that by becoming the premier carrier for complex, high-value shipments, it can build a more resilient and profitable business model, even if it means no longer being the biggest player in every market segment.

The Future of Logistics: A Value Driven and Digitally Powered Landscape

FedEx’s strategic pivot offers a glimpse into the future of the logistics industry. The era of brute-force, volume-based competition is giving way to a more sophisticated, value-driven paradigm. Going forward, success will be defined not by the number of packages moved but by the ability to provide specialized, tech-enabled solutions for complex supply chains. Innovations in AI, predictive analytics, and network automation will become critical differentiators, allowing carriers to optimize routes, enhance visibility, and offer customized services. This shift will likely lead to a more segmented market where different carriers specialize in different value propositions, from low-cost, high-volume delivery to high-touch, premium logistics.

Key Takeaways for the Modern Shipper

The primary takeaway from FedEx’s strategic shift is that the logistics landscape is prioritizing value over sheer volume. For businesses, this means re-evaluating their shipping needs and carrier relationships. Companies in high-stakes industries should seek partners like FedEx that are investing in the reliability and specialized services they require. For e-commerce businesses, it underscores the importance of a multi-carrier strategy to balance cost with the premium delivery experiences that discerning customers now expect. Ultimately, shippers must understand that the lowest price may no longer guarantee adequate service, and aligning with a carrier whose strategy matches their own brand promise is more critical than ever.

A New Definition of Success

In conclusion, FedEx’s move to prioritize profit over volume was a calculated response to an evolving market and a bold declaration about the future of logistics. By focusing on high-value segments, integrating its operations under the “One FedEx” model, and leveraging digital innovation, the company redefined success on its own terms. This strategic pivot was more than an internal corporate restructuring; it was a bellwether for an industry-wide transformation toward smarter, more efficient, and more profitable supply chains. For customers, competitors, and investors alike, the message was clear: in the new era of logistics, value, not volume, is king.