With decades of experience navigating the complexities of global supply chains, Rohit Laila offers a unique perspective on the future of logistics. We’re sitting down with him to discuss the recent launch of Polaris, a new Asia-Pacific cold chain platform by Morrison Global, which marks its entry with the strategic acquisition of SuperFreeze in Singapore. This move comes at a critical time, as the demand for sophisticated cold storage infrastructure continues to surge across the region, driven by the need for food and pharmaceutical security. Our conversation will explore Polaris’s ambitious expansion strategy, its approach to tackling Singapore’s storage shortages with advanced automation, and the sustainable technologies shaping the future of the cold chain.

Morrison Global has launched the Polaris platform through the acquisition of SuperFreeze. Beyond this initial step, what are the key milestones you aim to achieve in the next 18-24 months to establish a scalable, best-in-class platform across the wider Asia-Pacific region?

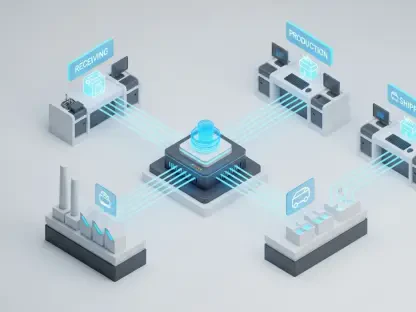

The acquisition of SuperFreeze is just the foundational piece, our launching point. Our immediate focus is on transforming this solid foundation into a truly regional powerhouse. Over the next 18 to 24 months, we are intensely focused on unlocking strategic opportunities across Asia, moving beyond a single-city operation. This means identifying and developing a network of advanced cold logistics facilities in key markets where demand is outpacing supply. We see this as a natural progression in our growth journey, where we can leverage Morrison’s deep expertise and financial strength to build a platform that is not just scalable but also sets a new standard for cold chain infrastructure in the region.

Singapore faces a persistent shortage of modern cold storage due to industrial land constraints. How will the automated SuperFreeze Tuas facility specifically address this supply-demand gap, and could you share any metrics on how this new capacity will improve food and pharmaceutical supply stability?

The situation in Singapore is quite acute; it’s a critical transshipment hub that is heavily reliant on imported food, yet structural constraints on industrial land have created a real bottleneck. The automated SuperFreeze Tuas facility directly confronts this challenge by maximizing density and efficiency on a limited footprint. Automation allows for higher racking, faster turnaround times, and precise inventory management, effectively increasing the usable capacity compared to a conventional facility of the same size. This enhanced capacity is absolutely vital for ensuring a stable supply of temperature-sensitive goods, especially for a high import-dependent economy. By closing that supply-demand gap, we are directly contributing to the resilience of the nation’s food and pharmaceutical supply chains.

Polaris aims to build a network of advanced facilities using high-efficiency refrigeration and distributed energy. Could you walk us through the specific technologies you plan to implement and how they will tangibly reduce the platform’s carbon impact while preventing product waste?

Our mission is to lead the transition toward a more sustainable cold chain, and technology is at the heart of that. We are strategically implementing high-efficiency refrigeration systems that consume significantly less power and use environmentally friendlier refrigerants. We couple this with distributed energy systems, like rooftop solar, to generate our own clean power on-site, which drastically reduces our reliance on the grid. This synergy not only minimizes our environmental footprint but also creates a more resilient operation. By ensuring consistent and reliable temperature control, these advanced systems are crucial in preventing spoilage and product waste, which is a massive issue in the logistics of both food and pharmaceuticals.

The acquisition gives Polaris an automated facility in a major transshipment hub. How does this high level of automation provide a competitive advantage in a dynamic market like Singapore, and what role will it play in shaping your regional expansion strategy?

In a high-velocity hub like Singapore, automation is not just a luxury; it’s a fundamental competitive advantage. The sheer volume of goods moving through the port for storage and transshipment demands speed, accuracy, and reliability that manual operations simply can’t match. Our automated facility in Tuas can handle goods faster, reduce labor-related errors, and provide real-time visibility, all of which are critical for our clients. This facility serves as our proof-of-concept and our operational blueprint. As we expand across the Asia-Pacific, we will replicate this model of high automation to ensure we can deliver a consistent, best-in-class service and efficiently manage the flow of temperature-sensitive goods in other key regional trade centers.

What is your forecast for the evolution of the cold chain logistics sector in the Asia-Pacific region over the next five to ten years?

I believe we are on the cusp of a significant transformation. The next decade in Asia-Pacific will see a major flight to quality, with customers increasingly demanding not just storage space, but technologically advanced, sustainable, and highly efficient logistics partners. We will see a consolidation away from older, inefficient facilities toward networks of automated hubs that can offer greater reliability and a lower carbon footprint. The demand for resilience in food and pharmaceutical supply chains will only intensify, making investments in modern infrastructure like ours essential. The future is a more integrated, data-driven, and sustainable cold chain that underpins the economic health and well-being of the entire region.