The trucking industry, often called the backbone of the American economy, is facing a harsh reality in 2025 as a freight recession, now stretching into its third year, has left fleets battered by stagnant rates and soaring costs, with profit margins shrinking to near invisibility. Picture a highway once bustling with rigs, now eerily quiet as companies struggle to keep their wheels turning. This crisis isn’t just a business problem—it’s a threat to the supply chain that delivers everything from groceries to medical supplies. How can an industry so vital endure such relentless pressure?

The stakes couldn’t be higher. With operating expenses climbing and freight demand faltering, thousands of trucking companies risk collapse, potentially disrupting the flow of goods nationwide. This downturn, described as historic in its severity, demands more than temporary fixes; it calls for strategic reinvention. The following exploration dives into the root causes of this economic storm, unpacks the multifaceted challenges fleets face, and offers actionable solutions to weather the crisis while building resilience for what lies ahead.

Why Surviving the Freight Recession Matters Now

The trucking sector’s struggle is a national concern, touching every corner of daily life. When fleets falter, the ripple effects hit consumers through delayed deliveries and higher prices for essentials. In 2025, the industry grapples with a prolonged downturn that has already outlasted typical cycles, pushing many smaller operators to the brink of bankruptcy. The urgency to adapt isn’t just about saving individual businesses—it’s about preserving the economic stability that depends on reliable transportation.

Beyond immediate survival, the broader implications are stark. A weakened trucking industry could undermine confidence in supply chains, slowing recovery across multiple sectors. Data from industry reports highlights that stagnant freight rates, paired with rising costs, have created a financial vise for carriers. This moment demands innovative thinking to prevent a deeper crisis, ensuring that goods keep moving even under economic strain.

Unpacking the Perfect Storm in Trucking

At the heart of this recession lies a convergence of punishing factors. Stagnant freight rates have failed to keep pace with inflation, while operating costs—fuel, maintenance, and labor—continue to climb. Industry analysis points to this imbalance as the core driver of profit erosion, distinguishing this downturn from previous cycles. Unlike past recessions, the current landscape shows no quick rebound, leaving fleets caught in a prolonged battle for solvency.

The national impact is impossible to ignore. Trucking moves over 70% of domestic freight, meaning disruptions here translate to empty shelves and delayed projects everywhere. This isn’t merely a niche issue for carriers; it’s a structural challenge affecting how efficiently the economy functions. Understanding these dynamics reveals why reactive measures fall short and why strategic overhauls are essential for endurance.

Key Challenges Pressuring Fleets Today

Drilling down into specifics, fleets face a gauntlet of economic hurdles. Vehicle prices have surged by over 50% since 2020, and looming 25% tariffs on truck-tractor imports threaten to pile on additional costs. These financial burdens strain budgets already stretched thin by volatile spot rates, making it harder to invest in growth or even maintain current operations.

Equally concerning are the risks of short-term cost-cutting. Slashing safety programs or maintenance schedules might save money upfront, but it often backfires through increased crashes or higher insurance premiums. Research underscores that safety investments can reduce accident rates by significant margins, proving that neglecting such priorities is a false economy. These intertwined pressures demand a careful balance between fiscal restraint and operational integrity.

Moreover, market volatility adds another layer of complexity. Spot rates fluctuate wildly, leaving carriers uncertain about revenue from week to week. This unpredictability, combined with rising expenses, creates a climate where only the most adaptable can survive. The challenge lies in navigating these obstacles without sacrificing the reliability that shippers and consumers depend on.

Insights From Experts and Real-World Examples

Industry research offers critical guidance amid this turmoil. Studies reveal a clear link between sustained safety investments and lower long-term costs, with well-implemented programs cutting crash rates and insurance expenses. Experts also emphasize the value of data-driven decisions, urging fleets to harness technology to track trends and optimize operations. Such insights provide a lifeline for carriers willing to prioritize strategy over panic.

The extended duration of this recession—already surpassing the typical 18-24 month window—adds to the urgency. Projections suggest recovery may not arrive until 2026 or beyond, meaning fleets must brace for a long haul. A hypothetical case illustrates this reality: consider a mid-sized carrier that pivoted to telematics for fuel efficiency, saving thousands monthly despite flat rates. This adaptability highlights how proactive steps can bridge the gap to better times.

Voices from the field echo these findings. While direct quotes are unavailable, the consensus among industry stakeholders points to resilience through innovation. Fleets that have weathered past downturns often cite flexibility and foresight as key to their survival. These perspectives reinforce the need for calculated risks now, ensuring that today’s decisions don’t jeopardize tomorrow’s opportunities.

Five Practical Strategies to Endure Economic Strain

Turning challenges into action, several targeted approaches can help trucking companies navigate this recession. First, balancing cost reductions with safety remains paramount. Maintaining robust safety programs and professional affiliations not only prevents accidents but also curbs insurance hikes. This dual benefit ensures stability without undermining service quality.

Second, managing equipment costs creatively offers relief from price surges. Extending truck lifecycles through meticulous maintenance, exploring leasing options, or sourcing from used-equipment markets can sidestep the impact of tariffs and inflation. Such measures preserve cash flow, allowing carriers to allocate resources where they’re most needed.

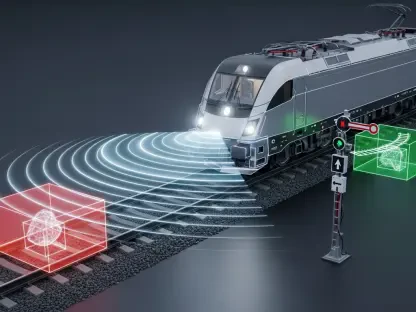

Third, technology serves as a powerful ally against inefficiency. Tools like telematics and predictive analytics enable precise routing and fuel optimization, cutting waste in measurable ways. Data also helps anticipate market shifts, empowering fleets to respond swiftly to economic pressures. Embracing these solutions transforms a cost center into a competitive edge.

Fourth, forging strong shipper partnerships stabilizes revenue in turbulent times. Securing long-term contracts and enhancing communication with clients can buffer against spot-rate volatility, ensuring consistent loads. This collaborative approach builds trust, positioning carriers as reliable partners even when demand dips.

Finally, preparing for recovery is a forward-thinking necessity. Learning from past downturns, fleets should strengthen finances, refine hiring processes, and plan scalable growth for an upturn potentially in 2026. Proactive steps taken now—such as building cash reserves or upskilling staff—lay the groundwork for a stronger rebound when conditions improve.

Reflecting on a Path Forward

Looking back, the freight recession of 2025 tested the trucking industry like few crises before it. Fleets faced unprecedented economic strain, yet many discovered that survival hinged on strategic adaptation rather than desperate cuts. The lessons learned underscored a vital truth: resilience required balancing immediate needs with long-term vision.

Moving ahead, carriers were encouraged to act decisively on multiple fronts. Investing in safety and technology proved not just practical but essential, while partnerships with shippers offered a buffer against uncertainty. Planning for recovery also emerged as a critical step, ensuring that companies could seize opportunities when the market finally turned. These actions, rooted in data and real-world experience, charted a course toward stability.

Beyond individual efforts, a collective push involving carriers, associations, and policymakers was seen as necessary to address systemic challenges. Advocating for fairer trade policies or fuel cost relief could ease burdens industry-wide. As the sector looked to the future, the focus shifted to building an ecosystem where innovation and collaboration paved the way for enduring success.