The logistics industry is projected to grow at an annual rate of 9.1% by 2030. One major driver of this growth is the rise of e-commerce, which has reshaped consumer expectations, creating an urgent demand for faster, more flexible delivery networks that many companies struggle to handle on their own.

Simultaneously, globalized trade and complex omnichannel retail strategies have added another layer of complexity to supply chains, requiring the expertise of specialized third-party logistics (3PL) providers. In this environment, the old model of owning massive fleets and warehouses is proving insufficient. This article explores how technology-first, asset-light logistics platforms are redefining industry leadership and why businesses that embrace this shift are better positioned to thrive in a rapidly changing market.

The Asset-Heavy Dilemma

For decades, the strength of a logistics company was measured by its physical footprint. More trucks, warehouses, and distribution centers meant greater market control. However, this asset-heavy model has significant disadvantages in today’s volatile, digital-first era.

At the same time, high capital expenditures, rigid operational structures, and slow adaptation to market shifts weigh on performance. When a disruption occurs, whether it is a port closure, a weather event, or a sudden spike in demand, asset-heavy providers often struggle to pivot. Their resources are fixed, and their capacity is finite.

In this case, shippers are left dealing with delays and escalating costs, while the provider contends with underutilized assets in one region and overwhelming demand in another. This inherent rigidity makes it difficult to compete, especially with the flexible, scalable solutions now entering the market. That’s why businesses need to move away from asset-heavy tactics to asset-light strategies.

A Blueprint for Asset-Light Success

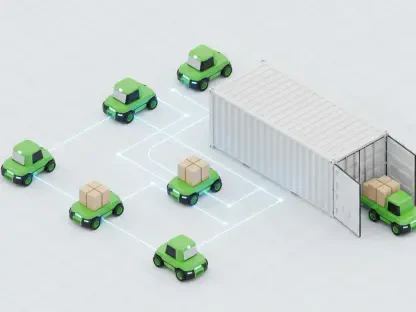

C.H. Robinson’s asset-light business model is uniquely suited to this dynamic environment. It prioritizes technological agility over heavy investment in physical assets. The company operates as a sophisticated freight brokerage, connecting a vast network of shippers with carriers through its proprietary technology platform. This strategy allows it to offer immense capacity without the balance-sheet burden of owning a fleet.

While C.H. Robinson’s current 5.74% share of the transportation market may seem modest, its steady growth from 5.53% a year earlier suggests its platform is gaining traction in a fragmented industry. This growth is not accidental. It is the direct result of a model designed for the challenges of modern commerce.

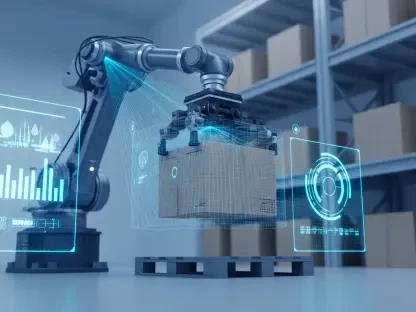

At the heart of this momentum is the ability to scale intelligently. By harnessing real-time data and predictive analytics, the company delivers smarter routing, better visibility, and faster problem-solving for customers. This operational precision reinforces C.H. Robinson’s role as a strategic enabler in today’s logistics ecosystem, with technology at the forefront.

The Technology That Powers Agility

The success of an asset-light model often stems from its reliance on orchestration and outsourcing. An agile technology platform acts as the central nervous system, processing immense amounts of data to optimize every decision. This goes far beyond simple load-booking applications.

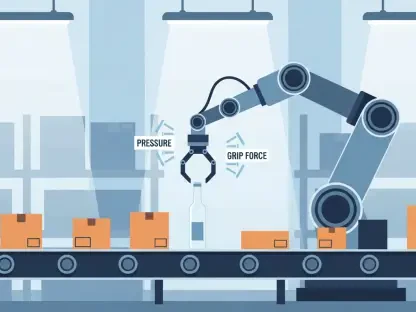

To support this level of intelligence and responsiveness, the key components of a company’s tech stack should include:

Predictive Analytics: Machine learning algorithms analyze historical data, weather patterns, and market demand to forecast shipping needs and optimize routes. This helps shippers avoid bottlenecks and secure capacity before rates spike.

Real-Time Visibility: By integrating with carrier telematics, IoT sensors, and mobile applications, these platforms provide shippers with end-to-end visibility of their freight. This transparency is no longer a luxury but a core expectation.

Dynamic Pricing Engines: Instead of relying on static rate cards, algorithms adjust pricing in real time based on capacity, demand, fuel costs, and dozens of other variables. This ensures fair market rates for both shippers and carriers.

Seamless API Integration: Modern platforms connect directly with a client’s enterprise resource planning and transportation management systems. This automates workflows, reduces manual data entry, and creates a single source of truth for all shipping activity. Studies show that companies with highly integrated supply chain technology achieve higher order fulfillment accuracy, reporting 20% more profitability and 25% higher productivity.

For example, a mid-sized retailer using an asset-light 3PL’s platform can navigate a sudden port strike with minimal disruption. The system’s AI detects the potential delay and automatically identifies alternative land-bridge and airfreight options from vetted carriers. Within hours, the shipment is rerouted, a process that would have taken days of manual phone calls and negotiations. This intervention reduces the client’s potential delay from two weeks to three days, preventing stockouts, preserving customer relationships, and increasing profitability.

But beyond its fast problem-solving capabilities, integrated technology is also changing how businesses think about their logistics partnerships.

Redefining the Logistics Partnership

A tech-driven, asset-light approach changes the dynamic for everyone. For shippers, it unlocks access to a large pool of capacity, providing the flexibility to scale up or down without long-term commitments. It transforms the 3PL from a simple vendor into a strategic partner that delivers data-driven insights to improve supply chain resilience and efficiency.

For carriers, especially small and mid-sized operators, these platforms provide access to a consistent stream of freight that would otherwise be difficult to secure. They level the playing field, allowing smaller fleets to compete for business from major corporations by tapping into the 3PL’s technology and network. While this can introduce pressure on margins, it also reduces the costly downtime associated with finding backhauls.

Looking forward, business leaders evaluating their logistics strategies must shift their focus to securing intelligence. The right partner offers not just transportation but also a platform for operational excellence. When choosing a logistics partner, your key strategic priorities should include:

Platform Scalability: Ensure the provider’s technology can support your growth and adapt to changing market conditions.

Data Transparency: Demand real-time visibility and access to analytics that can inform your business decisions.

Network Depth and Quality: A large network is ineffective without high standards for carrier performance and reliability.

Integration Capabilities: The provider must integrate seamlessly with your existing enterprise systems to automate processes.

Ultimately, the logistics landscape is splitting into two camps: those who move goods and those who manage the information that directs them. In an increasingly complex world, the latter holds the key to building a truly resilient and competitive supply chain.

Conclusion

The defining battle in logistics is no longer about who owns the most trucks. It is about who owns the smartest network. Companies that cling to asset-heavy models risk becoming slow-moving commodities in a market that rewards speed and intelligence. The most successful logistics providers of the next decade will function less like traditional freight companies and more like sophisticated software firms. Their value will be measured in their ability to orchestrate complexity, predict disruption, and deliver efficiency at scale. Is your company ready to lead the shift?